1.1 What is Financial Accounting?

Financial accounting is the process of recording, summarizing, and reporting business transactions to provide useful financial information. It helps businesses track performance, comply with regulations, and make informed financial decisions.

1.2 Importance of Financial Accounting

Decision Making: Helps businesses and investors evaluate financial health.

Legal Compliance: Ensures adherence to accounting standards (GAAP, IFRS).

Financial Transparency: Provides accurate financial information to stakeholders.

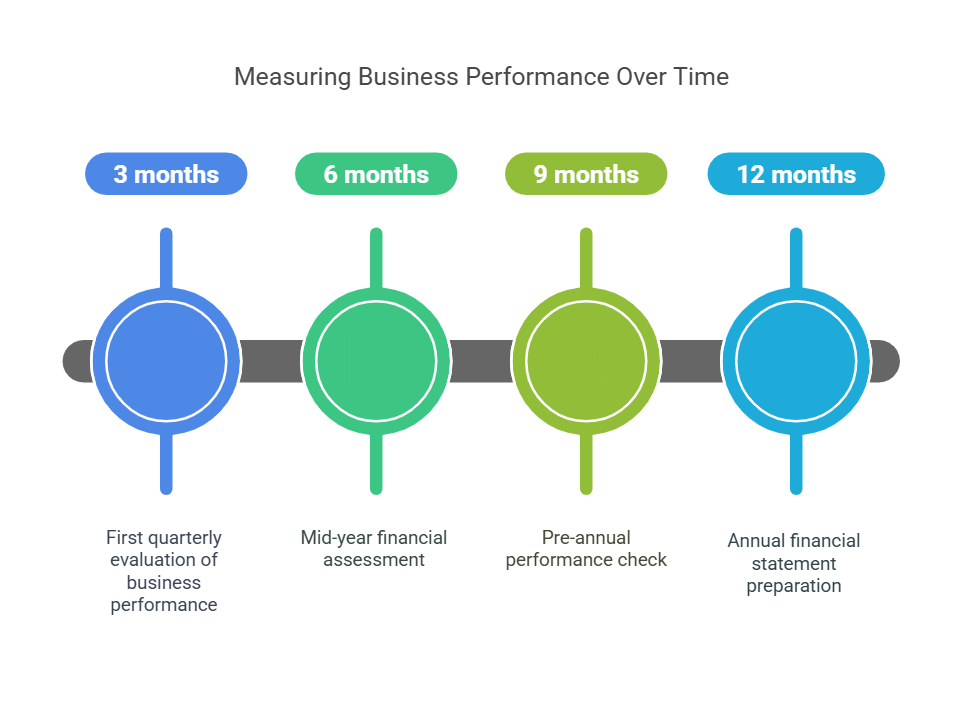

Performance Measurement: Tracks profits, expenses, and overall business success.

1.3 Key Users of Financial Accounting Information

Business Owners & Managers: Use financial reports for decision-making.

Investors & Shareholders: Assess company profitability and risks.

Lenders & Creditors: Determine creditworthiness before lending money.

Government & Regulatory Bodies: Ensure tax compliance and financial reporting accuracy.

1.4 Financial Accounting vs. Managerial Accounting

| Feature | Financial Accounting | Managerial Accounting |

|---|---|---|

| Audience | External (Investors, Regulators) | Internal (Managers, Executives) |

| Focus | Historical Financial Data | Future Planning & Strategy |

| Regulations | GAAP, IFRS Compliance | No strict regulations |

| Reporting Frequency | Periodic (Quarterly, Annually) | As needed (Daily, Monthly) |

1.5 The Accounting Principles & Standards

GAAP (Generally Accepted Accounting Principles): U.S. standard for financial reporting.

IFRS (International Financial Reporting Standards): Used in many countries for consistency in global financial reporting.

Accrual Principle: Revenue and expenses are recorded when incurred, not when cash is received.

Going Concern Principle: Assumes a business will continue operating in the foreseeable future.

1.6 The Role of Accountants in Financial Accounting

Recording transactions (Bookkeeping).

Preparing financial statements (Balance Sheet, Income Statement, Cash Flow Statement).

Ensuring compliance with laws and regulations.

Providing financial insights for business decisions.